As the price breaks $16, Chainlink gets longer-heavy: who's on top here? ChainLink Price Prediction

For Trading Crypto Join The Following Exchange

Sign Up Link: https://bingx.com/invite/8Z0PS4

Sign Up Now https://www.mexc.com/en-US/register?inviteCode=mexc-1PfPi

Join OKX https://www.okx.com/join/50165489

Bingx Joining Link https://bingx.com/invite/8Z0PS4

Over the past day, Chainlink has observed an accumulation of long contracts on Binance, which could indicate the impending peak of the cryptocurrency.

The Binance Chainlink Funding Rate Has Increased Significantly

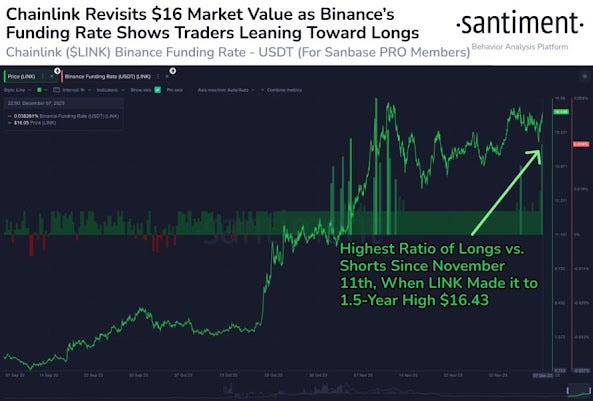

Data from Santiment, an on-chain analytics company, indicates that the Chainlink financing rate on Binance has now risen to its highest point in around four weeks. The periodic charge that derivative traders on a particular platform are currently exchanging with one another is referred to as the “funding rate.”

If this statistic has a positive value, it indicates that the long investors are now paying the short investors a charge to maintain their holdings. Such a pattern implies that the platform is dominated by bullish thinking.

Negative readings, on the other hand, indicate that most LINK traders on the exchange have a pessimistic attitude because there are more shorts than longs.

Here is a graph that illustrates the recent trend in the Chainlink funding rate on cryptocurrency exchange Binance:

The asset’s rise above $16 has resulted in a markedly positive value assumption for the Chainlink financing rate on Binance, as seen in the graph above.

For Trading Crypto Join The Following Exchange

Sign Up Link: https://bingx.com/invite/8Z0PS4

Sign Up Now https://www.mexc.com/en-US/register?inviteCode=mexc-1PfPi

Join OKX https://www.okx.com/join/50165489

Bingx Joining Link https://bingx.com/invite/8Z0PS4

The current ratio of longs to shorts is the largest since November 11th, when the price of the cryptocurrency reached its then-yearly high, which it has since surpassed.

In the past, an accumulation of longs in the derivatives market has frequently had a negative impact on the price. This is due to the fact that the side holding the most positions is typically more likely to be impacted by a large liquidation event known as a “squeeze.”

In a squeeze, a sharp change in price causes a significant number of liquidations, which in turn fuel the swing and cause a chain reaction of additional liquidations.

Given the notably favorable Chainlink financing rate, a long squeeze may occur more frequently than a short squeeze. Under these circumstances, the asset reached its local peak last month, thus it’s possible that it will happen again this time.

However, if LINK does see a pullback soon, the drop might not be that steep. This is because there seems to be some solid on-chain support between the $14.4 and $14.8.

For Trading Crypto Join The Following Exchange

Sign Up Link: https://bingx.com/invite/8Z0PS4

Sign Up Now https://www.mexc.com/en-US/register?inviteCode=mexc-1PfPi

Join OKX https://www.okx.com/join/50165489

Bingx Joining Link https://bingx.com/invite/8Z0PS4